Introduction to Trading Platforms in UAE

Overview of Trading Platforms

Trading platforms have revolutionized the way individuals in the UAE participate in financial markets. With various options available, selecting the right platform is crucial for successful trading. Here, we delve into the top trading platforms in the UAE, considering factors like user-friendliness, available assets, fees, and customer support.

Why Trading Platforms Matter

- Accessibility: Trading platforms provide easy access to global financial markets, allowing users to trade various assets from the comfort of their homes.

- Analysis Tools: These platforms offer a range of technical analysis tools that can help traders make informed decisions.

- Execution Speed: A good trading platform ensures quick order execution, vital in fast-moving markets.

- Risk Management: Many platforms offer risk management tools like stop-loss orders to help traders mitigate potential losses.

Transparency and Security

- Regulation: Opting for a platform regulated by reputable authorities provides a level of security and ensures fair trading practices.

- Data Security: Platforms with robust security measures protect users’ personal and financial data from cyber threats.

- Customer Support: Reliable customer support is essential for resolving any platform-related issues promptly.

Considerations for Beginners

- User-Friendly Interface: Novice traders may benefit from platforms with intuitive interfaces and educational resources.

- Demo Accounts: Platforms offering demo accounts allow beginners to practice trading in a risk-free environment.

- Low Minimum Deposits: For beginners with limited capital, platforms with low minimum deposit requirements are advantageous.

In the UAE, traders have a plethora of options when it comes to selecting a trading platform. Each platform caters to a specific type of trader, whether beginners looking for simplicity or experienced traders seeking advanced features. The choice ultimately depends on individual preferences, trading goals, and level of expertise.

Importance of Choosing the Right Trading Platform

Choosing the right trading platform is a critical decision for traders in the UAE, especially beginners. It can significantly impact their trading experience and overall success in the financial markets. Understanding the importance of selecting the most suitable platform is crucial for achieving trading goals and managing risks effectively.

Key Considerations When Selecting a Trading Platform

- User Experience: An intuitive and user-friendly platform can make trading more efficient and enjoyable, especially for beginners.

- Available Assets: Different platforms offer various assets like stocks, cryptocurrencies, forex, and commodities. Choosing a platform that aligns with your preferred assets is essential.

- Regulation and Security: Opting for a regulated platform ensures that your funds are secure and that you are trading in a transparent and fair environment.

- Trading Tools: Look for platforms that provide robust research tools, analysis capabilities, and risk management features to enhance your trading decisions.

- Cost and Fees: Consider the trading costs, fees, and commissions associated with each platform to optimize your profitability.

Risk Management and Education

- Risk Tolerance: Understanding your risk tolerance and the risk associated with each platform’s offerings is crucial to protect your capital.

- Education Resources: Choose a platform that offers educational resources, tutorials, and demo accounts to help you improve your trading skills.

- Support and Assistance: Reliable customer support can be a lifesaver when you encounter technical issues or have queries about trading on the platform.

Long-Term Strategy and Goals

- Trading Style: Consider your trading style, whether you are a day trader, swing trader, or long-term investor, and choose a platform that suits your strategy.

- Investment Goals: Align your platform choice with your investment goals, whether you aim for capital appreciation, income generation, or diversification.

In conclusion, the right trading platform acts as a foundation for your trading journey in the UAE. By considering these key factors and conducting thorough research, you can select a platform that meets your needs, enhances your trading experience, and aligns with your financial goals.

eToro

eToro Features and Benefits

eToro stands out as a top trading platform for beginners in the UAE, offering a range of features and benefits that cater to novice traders’ needs. Let’s explore what makes eToro a popular choice among traders looking to venture into the financial markets with confidence.

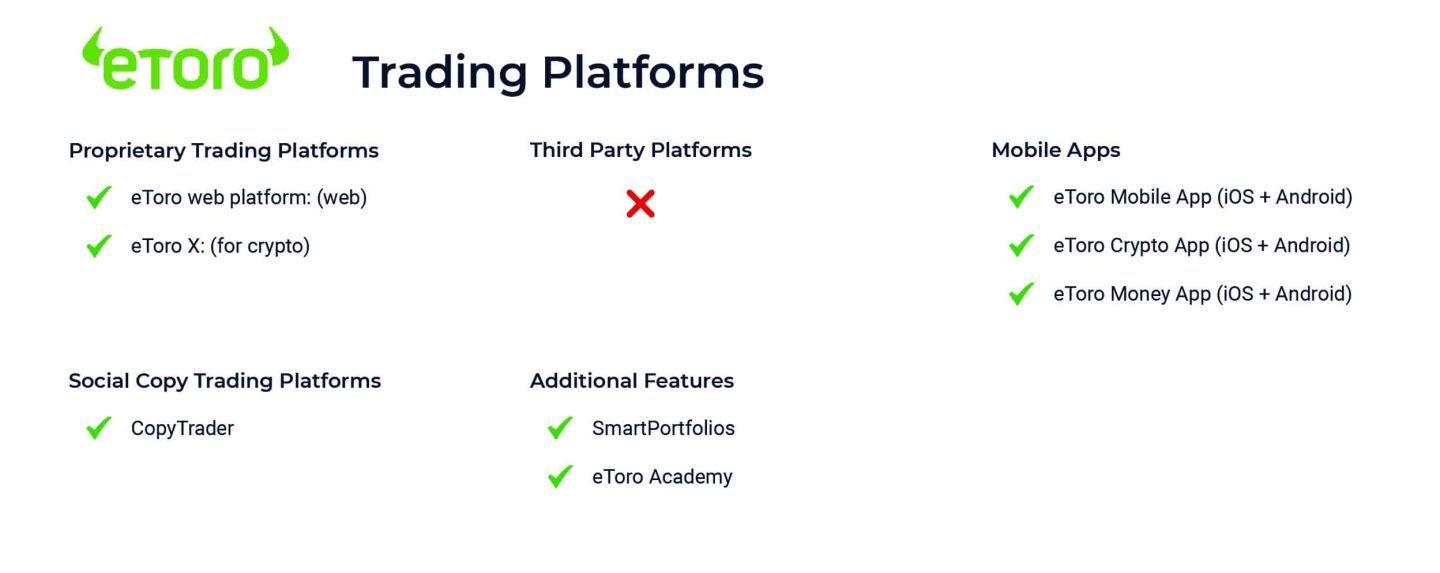

Key Features of eToro

- Social Trading: eToro’s social trading platform allows users to interact with and learn from a community of traders. This feature enables beginners to follow the trading strategies of experienced investors.

- Multi-Asset Platform: eToro offers a diverse range of assets to trade, including stocks, cryptocurrencies, forex, commodities, and more, providing ample opportunities for portfolio diversification.

- User-Friendly Interface: The platform’s intuitive interface makes it easy for beginners to navigate and execute trades efficiently.

Benefits of Using eToro

- Ease of Use: eToro excels in simplicity and ease of use, making it ideal for newcomers to the world of online trading.

- Straightforward Onboarding: The onboarding process on eToro is smooth and straightforward, allowing beginners to start trading quickly without unnecessary complications.

- Excellent Customer Support: eToro provides exceptional customer support in Arabic, catering to the needs of traders in the UAE effectively.

- Industry-Leading Social Trading: The social trading features on eToro allow beginners to learn from experienced traders and replicate their strategies, facilitating knowledge sharing and informed decision-making.

eToro’s commitment to providing a user-friendly experience, coupled with its innovative social trading features, makes it a standout choice for novice traders in the UAE. Whether you are interested in stocks, cryptocurrencies, or other financial instruments, eToro offers a comprehensive platform that supports your trading journey with the necessary tools and resources.

eToro Trading Instruments Available

eToro, recognized as the best trading platform in the UAE for beginners, provides access to a wide range of financial instruments, offering traders ample opportunities to diversify their portfolios and explore various asset classes. Let’s delve into the diverse array of trading instruments available on eToro’s platform.

Key Financial Instruments on eToro

- Stocks: Users can trade popular stocks from global markets, allowing them to invest in well-known companies and potentially benefit from stock price movements.

- ETFs (Exchange-Traded Funds): eToro offers a selection of ETFs, which are investment funds traded on stock exchanges, providing diversification and exposure to different sectors or asset classes.

- Forex (Foreign Exchange): Traders can participate in the forex market, trading currency pairs like EUR/USD, GBP/JPY, and more, to capitalize on exchange rate fluctuations.

- Indices: eToro provides access to a range of global indices, enabling traders to speculate on the performance of stock indices from various countries.

- Commodities: Users can trade commodities like gold, silver, oil, and more, allowing them to invest in physical assets and hedge against inflation or geopolitical risks.

- Cryptocurrencies: eToro supports the trading of popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, and others, catering to investors interested in digital assets.

- CFDs (Contract for Difference): With CFDs, traders can speculate on the price movements of various financial instruments without owning the underlying assets, offering opportunities for profit in both rising and falling markets.

By offering access to a diverse range of financial instruments, eToro empowers traders in the UAE to build a well-rounded investment portfolio and explore different markets based on their preferences and risk appetite. Whether you are interested in stocks, forex, cryptocurrencies, or other assets, eToro’s platform provides the tools and resources to support your trading objectives effectively.

IQ Option

IQ Option Platform Overview

When it comes to options trading platforms in the UAE, IQ Option stands out as a top choice for traders seeking a comprehensive and user-friendly platform. Let’s explore the key features and benefits that make IQ Option a preferred option trading platform for investors in the region.

Key Features of IQ Option Platform

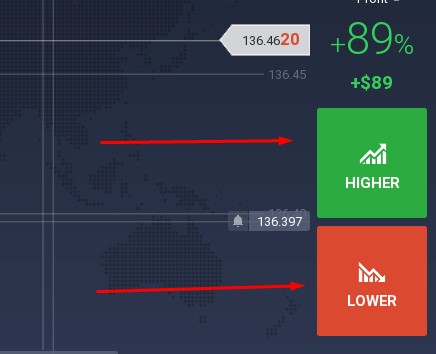

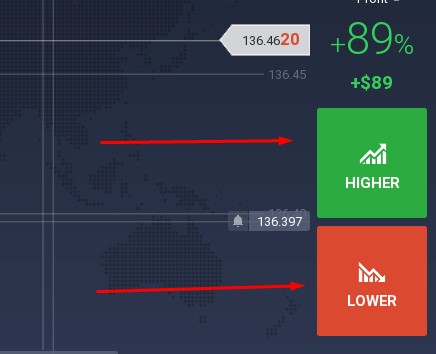

- Options Trading: IQ Option offers a robust options trading platform, allowing users to trade a variety of options contracts, including binary options and digital options.

- User-Friendly Interface: The platform’s intuitive and well-designed interface makes it easy for traders to navigate and execute trades efficiently.

- Advanced Charting Tools: IQ Option provides advanced charting tools and technical analysis features to help traders make informed decisions.

- Risk Management: Traders can utilize risk management tools like stop-loss orders and take-profit orders to control their positions and manage risk effectively.

Benefits of Using IQ Option

- Variety of Options Contracts: IQ Option offers a wide range of options contracts with different expiration times and strike prices, catering to various trading strategies.

- Educational Resources: The platform provides educational materials, tutorials, and webinars to help traders enhance their options trading knowledge and skills.

- Demo Account: Users have the opportunity to practice trading with a demo account, allowing them to test strategies and familiarize themselves with the platform without risking real money.

- Mobile Trading App: IQ Option offers a mobile trading app that enables traders to access the platform and trade options on the go, providing flexibility and convenience.

With its focus on user experience, educational resources, and a variety of options contracts, IQ Option emerges as a standout platform for options traders in the UAE. Whether you are a novice trader looking to learn about options trading or an experienced investor seeking advanced tools, IQ Option caters to a wide range of trading needs with its feature-rich platform.

IQ Option Account Types and Features

IQ Option, known for its options trading platform excellence, offers a range of account types and features to cater to the diverse needs of traders in the UAE. Let’s explore the different account options and standout features that IQ Option provides to its users.

Account Types on IQ Option

- Standard Account: The standard account on IQ Option is suitable for most traders and provides access to a wide range of options trading instruments and features.

- VIP Account: For advanced traders and high-volume investors, IQ Option offers a VIP account with additional perks such as higher leverage and personalized support.

Key Features of IQ Option Accounts

- Leverage: Traders on IQ Option can utilize leverage to amplify their trading positions and potentially enhance their profit opportunities.

- Risk Management Tools: IQ Option equips traders with risk management tools like stop-loss orders and negative balance protection to help mitigate potential losses.

- Market Analysis: The platform offers comprehensive market analysis tools, including technical analysis indicators and economic calendars, to assist traders in making informed decisions.

- Customer Support: IQ Option provides reliable customer support to assist users with account-related queries, technical issues, and trading assistance.

Special Features for IQ Option Users

- Demo Account: Users can access a demo account on IQ Option to practice trading strategies without risking real money, an ideal feature for beginners.

- Mobile Trading: IQ Option’s mobile trading app enables users to trade options on the go, ensuring flexibility and convenience.

- Educational Resources: The platform offers educational resources, webinars, and tutorials to help users enhance their options trading knowledge and skills.

With its diverse account types, essential features, and special offerings, IQ Option caters to traders of all levels in the UAE, providing a platform that combines user-friendly interface with advanced trading capabilities to support a successful trading journey.

XM

XM Trading Platform Analysis

When it comes to trading platforms in the UAE, XM is a well-known name that offers a comprehensive trading experience for investors looking to access global financial markets. Let’s delve into the analysis of XM’s trading platform, exploring its key features and benefits that attract traders in the region.

XM Platform Features

- Multiple Asset Classes: XM provides access to a diverse range of asset classes, including forex, stocks, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios.

- Leverage and Margin: Traders on XM can take advantage of leverage to amplify their trading positions, although it’s important to manage margin requirements carefully.

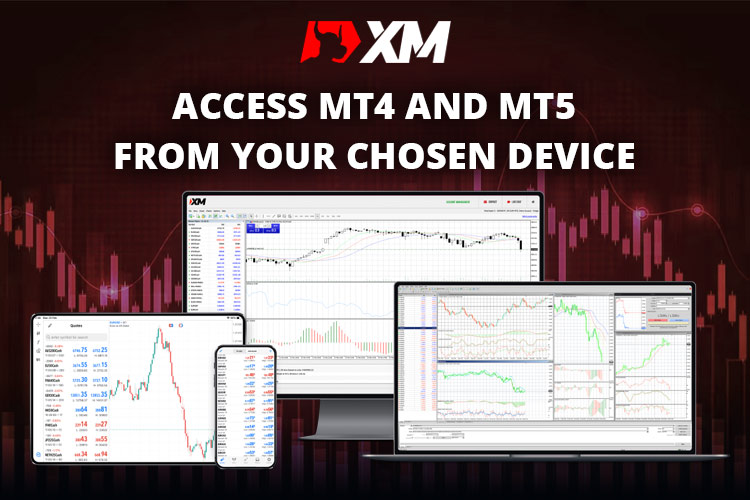

- MetaTrader Platforms: XM offers the popular MetaTrader 4 and MetaTrader 5 platforms, known for their advanced charting tools, technical analysis capabilities, and automated trading features.

- Research Tools: The platform provides traders with a variety of research tools, market insights, and economic calendars to help them stay informed about market trends and events.

Benefits of Using XM

- Regulation: XM is a regulated broker, providing a level of security and trust for traders who prioritize a safe trading environment.

- Customer Support: The platform offers multilingual customer support to assist traders with account-related queries, technical issues, and trading guidance.

- Educational Resources: XM provides educational materials, webinars, and seminars to help traders enhance their knowledge and skills in financial markets.

- Promotions and Bonuses: Traders may benefit from promotional offers and bonuses provided by XM, adding value to their trading experience.

By offering a user-friendly interface, a wide range of assets, advanced trading tools, and a commitment to customer support and education, XM remains a popular choice among traders in the UAE seeking a reliable and feature-rich trading platform for their investment needs.

XM Bonus and Loyalty Programs

In addition to offering a robust trading platform, XM provides bonus and loyalty programs to enhance the trading experience and incentivize traders in the UAE. Let’s explore the bonus offerings and loyalty programs available on XM, adding value to traders’ interactions with the platform.

XM Bonus Programs

- Welcome Bonus: XM may offer a welcome bonus to new traders who open an account and make their first deposit, providing them with additional funds to trade with.

- Deposit Bonus: Traders on XM could be eligible for deposit bonuses based on the amount they deposit into their trading accounts, boosting their trading capital.

- Special Promotions: XM regularly runs special promotions and bonus campaigns, such as cashback offers or trading competitions, rewarding active traders on the platform.

Loyalty Programs at XM

- XM Loyalty Program: Traders who demonstrate consistent trading activity and loyalty to the platform may be enrolled in XM’s loyalty program, where they can unlock additional benefits and rewards.

- VIP Program: For high-volume traders and elite clients, XM offers a VIP program with exclusive perks, personalized services, and enhanced trading conditions.

Benefits of Bonus and Loyalty Programs

- Increased Trading Capital: Bonus programs allow traders to boost their trading capital, enabling them to take advantage of more trading opportunities.

- Incentives for Trading: Loyalty programs incentivize traders to stay active on the platform, rewarding them for their continued loyalty and engagement.

- Exclusive Rewards: VIP programs offer exclusive rewards and benefits to high-value clients, enhancing their trading experience and catering to their specific needs.

By incorporating bonus and loyalty programs into its offerings, XM aims to create a rewarding and engaging trading environment for users in the UAE, providing additional value beyond the core trading platform features. Traders can leverage these programs to maximize their trading potential and enjoy added benefits as they navigate the financial markets through XM.

Plus500

Plus500 Platform Interface

When it comes to online trading platforms in the UAE, the Plus500 platform stands out for its intuitive interface and user-friendly design that caters to traders of all levels. Let’s explore the features and aspects of the Plus500 platform interface that make it a popular choice among investors in the region.

Key Features of Plus500 Platform Interface

- Sleek Design: The Plus500 platform boasts a clean and modern interface that is visually appealing and easy to navigate, providing a seamless trading experience.

- User-Friendly Layout: Traders can easily access essential tools, charts, and menus on the platform, allowing for efficient trade execution and analysis.

- Customization Options: Plus500 offers customization features that enable users to tailor the platform to their preferences, such as setting up watchlists and personalized alerts.

- Mobile Compatibility: The platform is optimized for mobile trading, ensuring that traders can access their accounts and trade on the go using the Plus500 mobile app.

Benefits of Using Plus500 Platform

- Accessibility: The intuitive interface of the Plus500 platform makes it accessible to traders of all experience levels, including beginners who are new to online trading.

- Efficient Trading Tools: Traders can utilize a range of trading tools and technical analysis capabilities available on the Plus500 platform to make informed trading decisions.

- Real-Time Updates: The platform provides real-time market data, price quotes, and performance metrics, allowing traders to stay informed about market movements.

- Risk Management Features: Plus500 offers risk management tools like stop-loss orders and trailing stops to help traders manage their risk exposure effectively.

By offering a user-friendly interface, advanced trading tools, and mobile compatibility, Plus500 caters to the needs of traders in the UAE who seek a reliable and efficient platform for their trading activities. The platform’s intuitive design and robust features contribute to a seamless trading experience for investors looking to engage in various financial markets.

Plus500 Trading Fees and Commissions

When it comes to trading in the UAE, understanding the fees and commissions associated with a broker like Plus500 is crucial for traders to evaluate the total cost of their trading activities. Let’s delve into the fees and commissions structure of Plus500, highlighting its competitive pricing and transparent fee policy.

Key Fee Components on Plus500

- Overnight Funding Fees: Traders holding positions overnight may incur overnight funding fees, which are charged for keeping positions open beyond a certain time.

- Currency Conversion Fees: Plus500 applies a currency conversion fee of 0.7%, which is relevant for trading instruments denominated in a currency different from the trader’s account base currency.

- Guaranteed Stop Order Fees: Traders opting for guaranteed stop orders to protect their positions from significant market movements may be subject to additional fees for this feature.

Competitive Pricing on Plus500

- Low-Cost Broker: Plus500 is recognized for its competitive fee structure, offering traders in the UAE access to one of the lowest-cost trading platforms available.

- Transparent Fee Policy: The broker maintains transparency in its fee disclosures, ensuring that traders are aware of the fees they may incur before executing trades.

- Cost-Effective Trading: With competitive overnight funding fees and currency conversion fees, Plus500 provides a cost-effective trading environment for UAE-based traders and investors.

By offering competitive fees and transparent pricing, Plus500 presents itself as a cost-efficient option for traders looking to manage their trading expenses effectively. Understanding the fee structure of Plus500 can help traders make informed decisions and optimize their trading strategies while keeping costs in check.

AvaTrade

AvaTrade Account Types

AvaTrade, a prominent online broker in the UAE, offers a variety of account types to cater to the diverse needs and preferences of traders. Understanding the different account options available on AvaTrade can help traders select the most suitable account for their trading style and objectives. Let’s explore the account types offered by AvaTrade:

Types of Accounts on AvaTrade

- Standard Account: The Standard Account on AvaTrade is designed for traders of all levels, offering access to a wide range of trading instruments and tools.

- Islamic Account: AvaTrade provides Islamic accounts that comply with Sharia law guidelines, catering to Muslim traders who require swap-free trading conditions.

- VIP Account: For high-volume traders and experienced investors, AvaTrade offers VIP accounts with enhanced features, personalized services, and premium trading conditions.

Key Features of AvaTrade Accounts

- Leverage Options: Traders on AvaTrade can select their desired leverage levels based on their risk tolerance and trading strategy.

- Risk Management Tools: AvaTrade equips traders with risk management tools like stop-loss orders and negative balance protection to help safeguard their capital.

- Educational Resources: The broker offers educational resources, webinars, and market analysis to help traders enhance their trading knowledge and skills.

- Dedicated Support: AvaTrade provides customer support to assist traders with account-related queries, technical issues, and trading assistance.

Benefits of AvaTrade Account Types

- Personalized Trading Experience: With a range of account types, AvaTrade allows traders to choose an account that aligns with their trading preferences and requirements.

- Compliance and Transparency: AvaTrade’s Islamic accounts ensure compliance with Islamic finance principles, providing an ethical trading environment for Muslim traders.

- Enhanced Services: VIP account holders on AvaTrade benefit from exclusive services, lower trading costs, and priority support, enhancing their overall trading experience.

By offering a diverse selection of account types with unique features and benefits, AvaTrade caters to a wide range of traders in the UAE, providing them with the flexibility and choice to select an account that suits their individual trading needs and preferences.

AvaTrade Educational Resources

AvaTrade is committed to empowering traders in the UAE with the knowledge and skills needed to navigate the financial markets successfully. Through its comprehensive educational resources, AvaTrade offers a wealth of learning materials, guides, and tools to support traders at every skill level. Let’s explore the educational resources provided by AvaTrade:

Types of Educational Materials Offered by AvaTrade

- Guides: AvaTrade offers informative guides that cover various aspects of trading, including technical analysis, fundamental analysis, risk management, and trading strategies.

- Ebooks: Traders can access ebooks on topics like CFD and forex trading, providing in-depth knowledge and insights into market dynamics and trading techniques.

- Video Tutorials: AvaTrade provides video tutorials that cater to different learning styles, offering visual explanations of trading concepts, platform tutorials, and market analysis.

Benefits of AvaTrade’s Educational Resources

- Enhanced Learning Experience: Traders can enhance their trading knowledge and skills through the diverse range of educational materials provided by AvaTrade.

- Accessibility: The educational resources are easily accessible to traders, allowing them to learn at their own pace and convenience.

- Practical Insights: By offering practical insights and real-world examples, AvaTrade’s educational materials help traders apply theoretical knowledge to actual trading scenarios.

- Continuous Support: The availability of 24/7 customer support in English and Arabic ensures that traders can seek assistance with educational resources and trading queries whenever needed.

AvaTrade’s commitment to education and trader development sets it apart as a broker dedicated to the success of its clients. By providing a wealth of educational resources tailored to traders’ needs and offering round-the-clock support, AvaTrade empowers traders in the UAE to make informed trading decisions and enhance their trading skills for long-term success in the financial markets.

XTB

XTB Platform Performance

When it comes to online trading in the UAE, XTB stands out for its exceptional platform performance that offers traders a seamless and efficient trading experience. Let’s delve into the key aspects that contribute to the high performance of XTB’s trading platform and why it is favored by investors in the region.

Key Features of XTB Platform Performance

- Multi-Country Presence: XTB’s global presence, with offices in more than 13 countries including Spain, the UK, France, Poland, and Germany, reflects its reliability and credibility as a leading online broker.

- Excellent Performance: XTB’s trading platform outperforms competitors, providing fast and reliable trade execution, real-time market data, and responsive charting tools.

- User-Friendly Interface: As a UAE trading app, XTB offers an interactive user interface with engaging visuals and intuitive navigation, making it easy for investors to navigate and utilize the app effectively.

- Advanced Technology: XTB leverages advanced technology to ensure smooth and efficient trading operations, catering to the needs of both novice and experienced traders.

Benefits of XTB’s Platform Performance

- Fast Execution: The high performance of XTB’s platform allows for quick order execution, essential for capitalizing on market opportunities.

- Reliability: Traders can rely on the stability and reliability of XTB’s platform, ensuring uninterrupted access to the financial markets during peak trading hours.

- Innovative Tools: XTB provides traders with innovative trading tools and features that enhance the trading experience, such as advanced charting capabilities and risk management tools.

- Optimized User Experience: The platform’s performance optimization contributes to a smooth and seamless user experience, enabling traders to focus on their trading strategies without interruptions.

By prioritizing performance, reliability, and user experience, XTB’s trading platform sets a high standard for online trading in the UAE, offering traders a competitive edge and the necessary tools to navigate the financial markets efficiently. The exceptional platform performance of XTB contributes to its reputation as a preferred choice for investors seeking a top-notch trading experience.

XTB Customer Support and Security Measures

When it comes to online trading, robust customer support and stringent security measures are essential aspects that traders consider when choosing a platform. XTB, a leading trading platform in the UAE, excels in providing reliable customer support and implementing comprehensive security measures to ensure a safe trading environment for investors. Let’s explore the customer support and security measures offered by XTB:

Customer Support at XTB

- 24/7 Availability: XTB offers round-the-clock customer support to assist traders with their queries, technical issues, and trading-related concerns at any time of the day.

- Multilingual Support: Traders in the UAE benefit from multilingual customer support, including English and Arabic, ensuring effective communication and assistance.

- Support Channels: XTB provides customer support through various channels such as email, live chat, WhatsApp, and phone, offering traders multiple options to reach out for help.

- Professional Assistance: The customer support team at XTB comprises knowledgeable professionals who are equipped to address traders’ inquiries promptly and efficiently.

Security Measures at XTB

- Regulation: XTB is regulated by reputable financial authorities, ensuring compliance with stringent regulations and providing a secure trading environment for investors.

- Data Encryption: The platform employs advanced encryption technology to safeguard sensitive personal and financial data, protecting traders from potential cyber threats.

- Secure Transactions: XTB prioritizes the security of transactions, implementing secure payment methods and protocols to prevent unauthorized access and ensure fund safety.

- Risk Management: XTB offers risk management tools and features to help traders mitigate risks and protect their investments while trading on the platform.

By prioritizing customer support excellence and implementing robust security measures, XTB demonstrates its commitment to providing a trusted and reliable trading environment for investors in the UAE. Traders can feel confident knowing that XTB offers responsive customer support and prioritizes data security to safeguard their trading activities and investments effectively.

IG Markets

IG Markets Trading Tools

When it comes to trading in the UAE, having access to advanced trading tools is essential for making informed decisions and optimizing trading strategies. IG Markets, a reputable online broker, offers a range of powerful trading tools that cater to the needs of both beginner and experienced traders. Let’s explore the trading tools provided by IG Markets:

Key Trading Tools Offered by IG Markets

- Charting Tools: IG Markets provides comprehensive charting tools with various technical indicators and drawing tools to analyze price movements and identify trading opportunities.

- Risk Management Features: Traders can utilize risk management tools such as stop-loss orders and limit orders to manage and control their trading risks effectively.

- Market Analysis: IG Markets offers market analysis tools, including economic calendars, news alerts, and research reports, to help traders stay informed about market trends and events.

- Algorithmic Trading: For advanced traders, IG Markets offers algorithmic trading tools that allow for automated trading strategies based on predefined parameters and algorithms.

Benefits of Using IG Markets Trading Tools

- Enhanced Decision-Making: The advanced trading tools provided by IG Markets empower traders to make well-informed decisions based on thorough analysis and research.

- Efficient Trading: With access to a variety of tools like charting, risk management, and market analysis, traders can execute trades efficiently and effectively.

- Automation Options: IG Markets’ algorithmic trading tools enable traders to automate their trading strategies, save time, and take advantage of market opportunities without constant monitoring.

- Educational Resources: IG Markets may complement its trading tools with educational resources and webinars to help traders improve their trading knowledge and skills.

By offering a suite of powerful trading tools, IG Markets equips traders in the UAE with the resources needed to navigate the financial markets with confidence and precision. Whether you are a beginner seeking educational tools or an experienced trader looking for advanced analysis features, IG Markets’ trading tools cater to a diverse range of trading styles and preferences.

IG Markets Research and Analysis

In the competitive landscape of online trading, research and analysis play a crucial role in helping traders make informed decisions and stay ahead of market trends. IG Markets, a renowned trading platform in the UAE, offers a comprehensive suite of research tools and in-depth analysis resources to empower traders with the insights they need to navigate the financial markets effectively. Let’s explore the research and analysis services provided by IG Markets:

Research Tools Offered by IG Markets

- Market News: IG Markets provides up-to-date market news and insights to keep traders informed about significant events and developments that may impact financial markets.

- Economic Calendar: Traders can access an economic calendar on IG Markets, highlighting key economic indicators, central bank meetings, and other important events affecting the markets.

- Technical Analysis: The platform offers advanced technical analysis tools, including chart patterns, technical indicators, and analysis techniques to help traders identify trends and trading opportunities.

- Trading Signals: IG Markets may provide trading signals and alerts based on technical analysis and market conditions, assisting traders in making timely and well-informed trading decisions.

Analysis Resources at IG Markets

- In-Depth Reports: Traders can access in-depth research reports and analysis from IG Markets’ team of experts, offering detailed insights into market trends, sectors, and specific assets.

- Expert Commentary: IG Markets may feature expert commentary and market analysis from industry professionals to help traders gain a deeper understanding of market dynamics and trends.

- Risk Management Strategies: The platform offers guidance on risk management strategies, helping traders mitigate risks and protect their capital while trading in volatile markets.

- Educational Webinars: Traders can participate in educational webinars and live seminars organized by IG Markets, providing valuable insights and trading tips from industry experts.

By providing a wealth of research and analysis tools, IG Markets equips traders in the UAE with the resources needed to stay informed, identify trading opportunities, and make informed decisions in the dynamic world of online trading. The comprehensive research and analysis services offered by IG Markets enhance the trading experience for investors, enabling them to navigate the markets with confidence and intelligence.

City Index

City Index Trading Platforms

City Index, a renowned market-leading provider, offers a range of award-winning trading platforms designed to cater to the diverse needs of traders in the UAE. From desktop platforms to mobile apps, City Index provides traders with innovative technology and exceptional service to enhance their trading experience. Let’s explore the trading platforms offered by City Index:

City Index Trading Platform Options

- Mobile Trading App: City Index offers a mobile trading app that allows traders to access the markets on the go, providing convenience and flexibility for active traders.

- WebTrader: The WebTrader platform by City Index offers a user-friendly interface that enables traders to execute trades, analyze markets, and manage their portfolios directly from their web browser.

- TradingView: Traders can utilize TradingView, a powerful charting platform integrated with City Index, to conduct in-depth technical analysis and make trading decisions based on advanced charting tools.

- MetaTrader 4: City Index supports the widely used MetaTrader 4 platform, known for its extensive range of trading tools, automated trading capabilities, and customizable features.

- Award-Winning Provider: City Index’s dedication to providing award-winning trading platforms reflects its commitment to excellence, innovation, and exceptional service for traders.

Risk Disclosure and Considerations

- CFDs Risk: City Index highlights the risks associated with trading Contracts for Difference (CFDs), emphasizing the high risk of losing money rapidly due to leverage.

- Retail Investor Warning: City Index cautions retail investors that CFD trading involves a high level of risk, with a significant percentage of accounts experiencing losses.

- Risk Management Awareness: Traders are urged to understand how CFDs work, assess their risk tolerance, and consider the potential financial risks before engaging in trading activities.

By offering a suite of award-winning trading platforms and emphasizing risk disclosure and awareness, City Index demonstrates its commitment to providing traders in the UAE with top-tier technology, service, and support to navigate the financial markets confidently and responsibly.

City Index Mobile Trading App

City Index, a reputable online broker, offers a cutting-edge mobile trading app that allows traders in the UAE to access the financial markets with ease and convenience right from their smartphones or tablets. The City Index mobile app is designed to provide a seamless and user-friendly trading experience for both novice and experienced traders. Let’s explore the features and benefits of the City Index Mobile Trading App:

Key Features of City Index Mobile Trading App

- User-Friendly Interface: The mobile app from City Index boasts a user-friendly interface with intuitive navigation, making it easy for traders to place trades and monitor their portfolios on the go.

- Real-Time Market Data: Traders can access real-time market data, price quotes, and charts on the mobile app, allowing them to stay informed about market movements and make timely trading decisions.

- Trade Execution: The City Index mobile app enables swift trade execution, ensuring that traders can capitalize on market opportunities quickly and efficiently.

- Risk Management Tools: Traders can utilize risk management tools like stop-loss orders and take-profit orders on the mobile app to manage their positions effectively and control risks.

Benefits of Using City Index Mobile Trading App

- Flexibility and Convenience: The mobile app provides traders with the flexibility to trade from anywhere at any time, allowing them to stay connected to the markets even while on the move.

- Access to Multiple Asset Classes: Traders can trade a wide range of assets, including forex, stocks, commodities, and indices, directly from the mobile app, catering to diverse trading preferences.

- Customization Options: The City Index mobile app offers customization options, allowing traders to personalize their trading interface and set up alerts and notifications according to their preferences.

- 24/7 Access: With the mobile app, traders have 24/7 access to the markets, enabling them to react to market developments and news events in real time for informed trading decisions.

The City Index Mobile Trading App serves as a powerful tool for traders in the UAE, offering a convenient way to trade, monitor markets, and manage positions on the go. With its user-friendly interface, real-time data, and efficient trade execution, the mobile app enhances the trading experience for users, providing them with the tools they need to navigate the financial markets effectively.

Conclusion

Comparison of the Top 10 Trading Platforms in UAE

Navigating the plethora of trading platforms available in the UAE can be a daunting task, especially for beginners looking to kickstart their trading journey. To simplify the selection process, let’s compare the key features of the top 10 trading platforms in the UAE, helping traders make an informed decision based on their preferences and trading goals:

eToro

- Best Overall Trading Platform for Beginners

- Social trading features for learning from experienced traders

- Diverse range of assets including stocks, cryptocurrencies, and forex

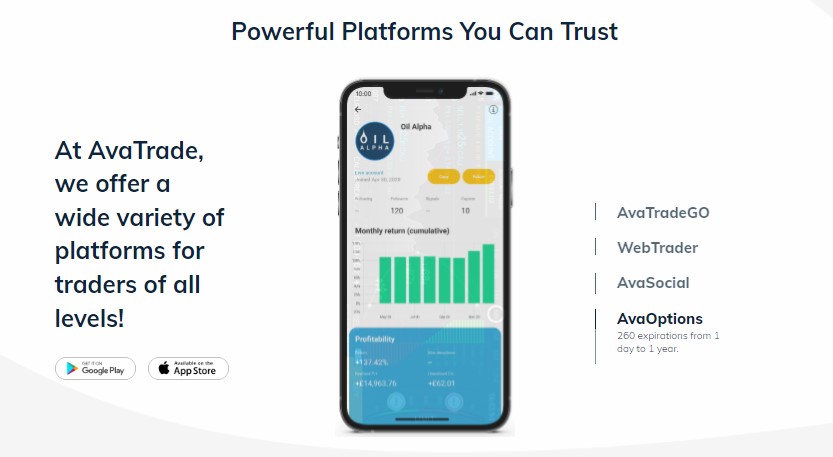

AvaTrade

- Top Choice for Forex Traders

- Multiple account types catering to different trading styles

- Comprehensive educational resources for traders

Plus500

- Best for Mobile Trading

- Intuitive mobile app for trading on the go

- Low trading fees and tight spreads

Pepperstone

- Ideal for CFD Trading

- Access to a wide range of CFD products

- Advanced trading tools and research resources

Interactive Brokers

- Great for Stocks and ETFs

- Large selection of stocks and ETFs from global markets

- Advanced trading platform with customizable features

Saxo Bank

- Best Advanced Trading Platform

- Professional-grade trading tools and analysis

- Access to global markets and a wide range of trading instruments

Sarwa

- Best Full-Service Stock Broker in the UAE

- Robo-advisory services for hassle-free investing

- Automated portfolio management and rebalancing

By comparing the features and strengths of the top 10 trading platforms in the UAE, traders can evaluate which platform aligns best with their trading preferences, experience level, and financial objectives. Whether prioritizing user-friendly interfaces, educational resources, or a diverse range of tradable assets, choosing the right trading platform is essential for a successful trading experience.

Key Considerations for Choosing a Trading Platform

Selecting the right trading platform is a crucial decision for traders in the UAE, as it can significantly impact their trading experience, profitability, and overall success in the financial markets. When evaluating trading platforms, it is essential to consider several key factors to ensure that the chosen platform aligns with individual trading goals and preferences. Let’s explore the key considerations for choosing a trading platform:

Regulation and Security

- Regulatory Compliance: Opt for a platform that is regulated by reputable authorities, ensuring that the broker operates within legal boundaries and adheres to industry standards.

- Data Security: Choose a platform that employs advanced encryption protocols to protect your personal and financial information from unauthorized access and cyber threats.

Asset Availability and Instrument Variety

- Diverse Asset Classes: Look for platforms that offer a wide range of assets such as stocks, forex, cryptocurrencies, commodities, and indices to diversify your investment portfolio.

- Trading Instruments: Consider the availability of different trading instruments like options, CFDs, ETFs, and more to cater to your trading preferences and strategies.

Trading Tools and Features

- Charting Tools: Evaluate the charting capabilities and technical analysis tools offered by the platform for conducting in-depth market analysis and making informed trading decisions.

- Execution Speed: Prioritize platforms with fast order execution and minimal latency to ensure timely trade placements and optimal price fills.

- Risk Management: Look for platforms that provide risk management tools like stop-loss orders, guaranteed stop orders, and negative balance protection to manage and mitigate risks effectively.

Cost and Fees

- Fee Structure: Consider the trading fees, commissions, spreads, and other costs associated with using the platform to optimize profitability and minimize trading expenses.

- Account Types: Choose a platform that offers account types suitable for your trading style and capital requirements, whether you are a beginner or a seasoned investor.

By carefully evaluating these key considerations when choosing a trading platform, traders in the UAE can select a platform that aligns with their individual needs, preferences, and risk tolerance, setting the foundation for a successful trading journey in the dynamic financial markets.

![Illustration of a man in a business suit, sitting cross-legged and meditating, against a dark blue background with the text "CTO as a Service [2024]" and "WHY DO YOU NEED A CTO IN THE FIRST PLACE?".](https://evotik.com/wp-content/uploads/2024/04/CTO-as-a-Service-Evotik-Blog-Featured-Image.png)