The digital banking landscape in the UAE is evolving rapidly, offering businesses advanced financial tools designed for modern commerce. In 2024, we review here many available options to help you make a decision about your business bank account, many advantages are there making these banks ideal for companies in the UAE. This blog explores UAE’s top 12 digital banks that cater to various business needs, from startups to established enterprises.

Understanding Digital Banks in UAE

Digital banks, often called neobanks, offer banking services through digital platforms such as mobile apps and websites, but many of them offer offline banking as well casino welcome bonus so nothing to worry about. These banks are renowned for their efficiency, reduced fees, and user-centric design. They provide various services, from essential account management to complex financial integrations using APIs as well.

Why Choose Digital Banks for Business in Dubai?

Choosing a digital bank for your business in Dubai means embracing flexibility, enhanced security, and innovative financial solutions. Digital banks often offer:

- Customized banking solutions tailored for different business sizes and industries.

- It enhanced digital security protocols to protect financial transactions.

- Integrated business services, including invoicing, payroll management, and easy international transfers.

If you are building an online store you will need a payment gateway not only a bank account.

Top 12 Digital Banks

in UAE for Business

in 2024

Wio Bank

Wio Bank, licensed in 2022, is a modern digital bank that provides banking services to SMEs, freelancers, and e-commerce businesses. Wio offers personal and business accounts, embedded finance solutions, and banking-as-a-service (BaaS), which is particularly attractive to digital and e-commerce platforms looking to integrate financial services.

Its products include saving spaces, debit cards, virtual cards, and comprehensive online transfer capabilities in AED and USD, catering to local and international business needs.

YAP

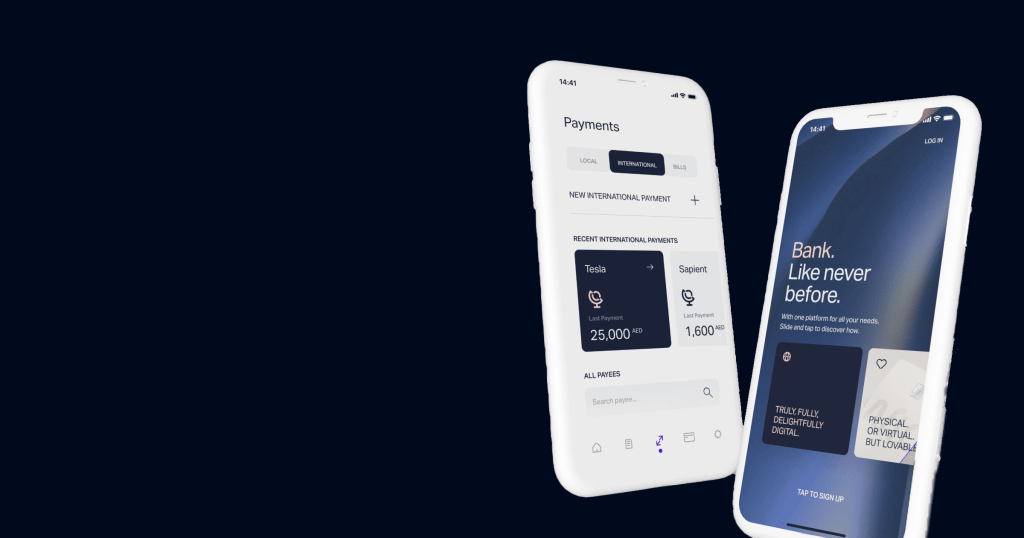

Although not a licensed bank, YAP operates in partnership with RAKBank to deliver innovative digital payment solutions. It caters mainly to UAE residents, providing instant bank transfers and spending analytics services.

YAP users receive an IBAN issued from RAKBank and have access to virtual cards, equity trading, and loan services delivered through RAKBank’s established infrastructure. This collaboration allows YAP to offer a unique blend of fintech innovation with the reliability of a traditional bank.

Zand Bank

Zand Bank, licensed as a fully independent commercial bank in 2022, is poised to transform the banking landscape in Dubai. It offers a suite of services for retail and corporate clients, focusing on accounts, cards, loans, and comprehensive money management tools.

Zand Bank is inviting UAE businesses to benefit from its innovative banking solutions, including lending and account services designed to streamline financial operations and enhance growth potential. Its no-physical-branch model reduces operational costs, translating to better customer rates.

Ziina

Ziina simplifies financial transactions in the UAE, offering a seamless platform for money transfers. Both personal and business needs are catered to, with various payment methods available, including debit cards, credit cards, Apple Pay, and Google Pay. Its user-friendly interface serves a diverse user base, from entrepreneurs to individuals seeking convenience.

For businesses, Ziina provides an innovative payment gateway supporting cashless transactions across multiple channels, including social media and in-person interactions. Integration with major payment methods ensures easy management and security. With transparent pricing and no hidden fees, Ziina is positioned as a reliable choice for financial freedom, emerging as a leading payment solution in the Middle East.

Balance

Balance is a digital wallet platform offering fast and secure money transfers. Users can connect their credit cards or bank accounts, add funds to their wallet, and easily transfer money. The highest level of security for financial transactions is ensured.

With Balance, users enjoy exclusive privileges like transferring funds, paying businesses, and accessing special benefits, creating a seamless financial management experience. It provides convenient ways to send and receive money, make payments at partner stores, and utilize features like QR codes and ApplePay. User verification for security and support for various payment methods cater to diverse user needs.

Zywa

Zywa, a UAE-based neobank, recently secured $3 million in funding, with a valuation of $29.9 million. CEO Alok Kumar highlighted the company’s focus on Gen Z’s digital payment needs, addressing their $1.36 billion annual spending in the UAE. Zywa offers a digital platform for teens aged 11 to 25, facilitating cashless transactions and parental oversight. The funding supports Zywa’s expansion to Egypt and Saudi Arabia by early 2023, reflecting the thriving fintech landscape in the MENA region.

Mashreq Neo

Mashreq Neo, launched by Mashreq Bank, provides a digital-first banking experience with a strong focus on catering to the diverse needs of businesses in the UAE. It offers a comprehensive suite of services, including multi-currency accounts, easy international transfers, and robust customer support.

The bank’s digital platform enables businesses to manage their financial operations seamlessly, from account opening to managing investments. Mashreq Neo’s integration of over 400 ATMs across the UAE and its capability to send money to 40 countries make it a prime choice for enterprises looking for expansive network support and global reach.

Liv. by Emirates NBD

Liv. by Emirates NBD targets the tech-savvy younger generation of entrepreneurs, offering a digital banking solution as dynamic as their business needs. With features like instant account opening, innovative budgeting tools, and personalized financial advice, Liv. Supports young business owners in achieving their financial goals.

The bank also offers specialized accounts for savings and investments, and its rewards programs provide added benefits from popular brands, enhancing its appeal to a younger demographic looking for more than just traditional banking.

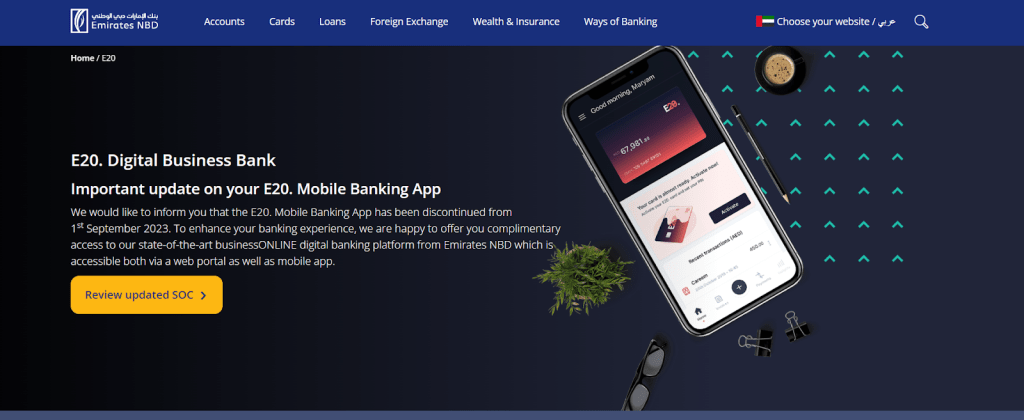

E20. by Emirates NBD

E20. by Emirates NBD is specifically designed for small and medium-sized enterprises (SMEs) in the UAE. This digital bank simplifies business banking by providing tools for expense management, instant invoicing, and digital payroll solutions. E20. offers different banking packages that cater to varying business needs and scales, requiring different average monthly balances.

It’s particularly beneficial for businesses interacting with the Department of Economic Development (DED), as the bank’s services are tailored to comply with local regulations and enhance business operations in mainland areas.

ADIB SmartBanking

ADIB SmartBanking offers a digital-centric approach tailored to meet the needs of Millennials and tech-forward business owners. This Abu Dhabi Islamic Bank (ADIB) platform supports various financial activities, including local and international transfers, transaction tracking, and credit card management through a user-friendly mobile app.

ADIB SmartBanking integrates Islamic banking principles with modern digital solutions, offering Mudarabah-based savings accounts and personalized financing options. It is a suitable choice for businesses looking for Sharia-compliant financial services.

DIB Smarter Banking

Dubai Islamic Bank’s DIB Smarter Banking caters to businesses looking for Islamic banking solutions integrated with advanced digital features. This platform offers various services, including digital account opening, financial management, and compliance with Islamic finance principles. DIB Smarter Banking is designed to support the unique requirements of Islamic businesses, providing a seamless and compliant banking experience that aligns with their values and financial objectives.

ADCB Hayyak

ADCB Hayyak offers an instant digital banking solution ideal for businesses seeking swift and efficient service. With features like real-time account opening and tailor-made banking services, ADCB Hayyak addresses the demand for quick financial management tools.

Its user-friendly platform makes it accessible to both tech-savvy users and those new to digital banking, thus ensuring a broad appeal across various business sectors in the UAE.

How to Choose the Right Digital Bank in UAE for Your Business

When selecting a digital bank for your business in Dubai or UAE, consider the following:

- Specific Needs: Assess the specific banking needs of your business, such as international transfers, payroll management, or flexible credit options.

- Security Features: Ensure the bank offers robust security measures to protect your financial data.

- Customer Support: Opt for banks that provide responsive customer support, which is essential for promptly resolving business banking issues.

- Ease of Setup of course!

Conclusion

UAE’s digital banking landscape presents many options, each tailored to meet the distinct needs of businesses at various stages of growth. From startups seeking agility and innovation to established enterprises looking for robust financial management tools, the top digital banks in Dubai are equipped to support the diverse financial demands of the business community.

These banks leverage cutting-edge technology to offer secure, efficient, and user-friendly banking experiences, enhancing operational efficiencies and enabling businesses to thrive in a competitive market. By choosing the right digital bank, companies in Dubai can not only manage their finances more effectively but also gain strategic insights and support to drive growth and success in the dynamic economic environment of the UAE.

![payment gateways uae [2024]](https://evotik.com/wp-content/uploads/2024/04/image-5-150x150.png)

![payment gateways uae [2024]](https://evotik.com/wp-content/uploads/2024/04/image-5.png)