Explore the Best Instant Cash Loan Apps in UAE for Quick Financial Solutions

Cash is the oxygen of business, many times business find themselves in need of quick reliable cash loans to keep their business alive. We researched for hours to bring you a fair (non-affiliated) comparison between Loan Apps in UAE.

Having access to quick financial assistance can be a game-changer, especially in a dynamic region like the UAE. Navigate with this ultimate guide through more than 13 cash loan apps to easily secure your business oxygen in Dubai or in the UAE as a whole.

What are Cash Loan Apps? Understanding Their Popularity in the UAE

Cash Loan Apps in UAE are digital platforms that allow users to apply for and receive loans quickly and easily and regulated in the UAE. The apps typically require less documentation and provide faster approval than traditional bank loans, making them ideal for urgent financial needs of businesses and startups.

Leading Cash Loan Apps in UAE

Beehive

Beehive is an e& enterprise company, is MENA’s first regulated online marketplace for peer-to-peer lending. Its business depends on faster cash access for businesses and higher returns for investors on their money loaned.

It is regulated by the DFSA since 2017 and well supported by the Government of Dubai. Any business can very easily check its eligibility to get a lone through beehive using this form.

Their process is fairly simple, you submit your business, it gets approved and listed on their website, there an investor can find your business and decide to fund your finance request. It is important to note that it is Sharia compliant as well.

Advantages of Beehive:

- DFSA Regulated.

- Quick loan processing & approval.

- Suitable for Small Businesses.

- Sharia Compliant.

FlexxPay

FlexxPay is a loan app that allows employees to access a part of their already earned salary & commission any time during the month without the employer paying that upfront. They started offering this service in 2018 and they offer that in UAE, KSA and Egypt (and expanding)

So this has advantages for employees accessing funds and for employers keeping up their cash flow while keeping their employees comfortable which boosts their retention and productivity. It is proven to increase sales and decrease.

So just imagine as a business owner your employee need some upfront payment on his salary (which he earned) and you have FlexxPay pay him instead of you, while they settle with you at your payroll cycle (time where you actually pay salaries!), isnt that awesome?! it is.

FlexxPay are Sharia Compliant and it pays employees portion of their income date any day of the month with no interest for a fixed fee, so it is actually not a loan.

Advantages of FlexxPay:

- Instant Access to Money.

- Suitable for Small Businesses.

- Sharia Compliant.

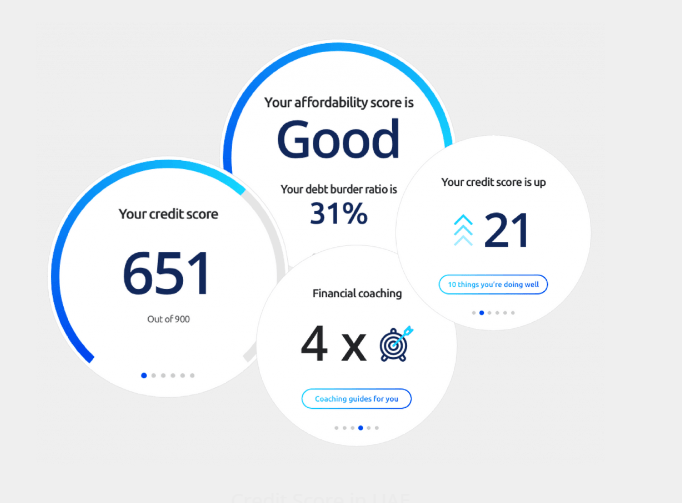

MoneyMall

MoneyMall is an app that compares nearly 100 financial products from over 50 top providers in the UAE. It helps users find the best financial deals easily and efficiently.

The app offers features like multiple loan options, a comparison tool, and personalized offers. It ensures user privacy with bank-grade encryption and provides unbiased financial product comparisons, making it a trusted platform.

MoneyMall stands out with its intuitive interface, allowing users to navigate various financial products effortlessly. It provides detailed information on each product, ensuring transparency and helping users make informed decisions.

The app also sends personalized notifications, keeping users updated on their credit scores, borrowing power, and tailored financial products. This feature helps users stay informed about their financial status and opportunities.

Advantages of MoneyMall:

- Extensive Information

- Offer based on individual credit scores.

- Privacy and Security

- Free Service

ADCB Hayyak

ADCB Hayyak allows users to instantly apply for and receive loans through its app, promoting a quick and easy account setup followed by immediate fund disbursement.

- ADCB Hayyak allows for an instant loan application and approval process through the app.

- Users can manage the entire process digitally, from application to fund disbursement.

- It integrates a loan calculator to help users understand their financial commitments before agreeing to terms.

- The app is part of the Abu Dhabi Commercial Bank, ensuring a reliable and secure service.

- ADCB Hayyak suits tech-savvy users looking for a modern and efficient loan service.

Mashreq

Mashreq provides rapid loan approvals, often within 5 minutes, offering significant loan amounts up to 20 times the user’s salary, making it a very appealing option for immediate financial needs.

- Mashreq promises instant loan approvals, sometimes in as little as 5 minutes.

- The app can provide loans up to 20 times the user’s salary, making significant amounts accessible.

- It stands out for its speed and convenience, which make it ideal for urgent and substantial financial requirements.

- Mashreq integrates seamlessly with banking services, offering a comprehensive financial tool.

- It is a preferred option for those who need quick financial assistance without a lengthy approval process.

Emirates NBD

A government-owned entity, Emirates NBD sanctions loans up to AED 200,000 with a 24-hour approval timeline, featuring competitive interest rates starting from 14.99%.

- Emirates NBD offers substantial loans up to AED 200,000 with a fast approval process within 24 hours.

- Owned by the government of Dubai, it boasts high trustworthiness and robust financial backing.

- The app provides competitive interest rates starting at 14.99%, making it financially attractive.

- Repayment terms are flexible, with options extending up to 48 months.

- Emirates NBD serves UAE nationals and expats, providing broad access to financial services.

RakBank

Known for its simplicity and speed, RakBank requires no complex salary transfers and offers loans up to AED 150,000, with repayment directly debited from your salary account.

- RakBank facilitates loans up to AED 150,000 without complicated salary transfer mechanisms.

- The application process is straightforward, with direct debit repayment options from your salary account.

- Known for its simplicity and user-friendliness, it appeals to many borrowers.

- Quick approvals and competitive interest rates are vital features that enhance its attractiveness.

- RakBank is ideal for customers who prefer a hassle-free approach to securing a loan.

Liv Bank

Targeting more minor loan needs, Liv Bank provides up to AED 20,000 at an 8.99% annual interest rate, with flexible repayment terms of 12 to 48 months.

- Liv Bank specializes in smaller loans, offering up to AED 20,000 at a competitive interest rate of 8.99% annually.

- It provides flexible repayment terms ranging from 12 to 48 months.

- The app is designed for those who need quick cash for minor emergencies or expenses.

- Liv Bank’s process is streamlined, allowing easy and rapid loan approvals.

- Its focus on smaller, manageable loans makes it unique among the larger loan providers.

Cash Now

This app stands out for its ability to offer quick financial aid with minimal application steps, making it ideal for urgent cash needs.

- Cash Now is renowned for delivering urgent cash loans with minimal procedural delays.

- The application process is designed to be quick and easy, often requiring just a few taps on your device.

- It’s an ideal solution for unexpected financial emergencies like healthcare costs or sudden expenses.

- Cash Now offers a user-friendly interface that simplifies the borrowing experience.

- As one of the best apps for urgent cash needs, it ensures users receive funds promptly.

E& Money

E& Money is noted for its efficient processing, offering a streamlined application process that meets urgent financial needs quickly.

- E& Money provides quick cash loans with a straightforward and speedy application process.

- The app caters to urgent financial needs, ensuring users can access funds without delays.

- It is known for its efficiency and ease of use, appealing to users who value simplicity.

- E& Money maintains competitive interest rates and flexible repayment options.

- It’s perfect for borrowers looking for a no-fuss, quick financial solution.

Pay-by Mobile Payment

Integrating loan services with mobile payments, this app ensures immediate cash is added to your mobile wallet, simplifying the borrowing process.

- Pay-by-Mobile Payment innovates loan services by integrating with mobile payment systems.

- It offers instant cash that users can receive directly in their mobile wallets.

- The app simplifies the loan application process, making it accessible even for tech novices.

- It suits younger users or those who prefer mobile-based financial transactions.

- Pay-by-mobile payment combines convenience with speed, embodying a modern approach to personal loans.

Simplylife

Simplylife caters to emergencies with a priority call-back service and charges no extra fees for early loan settlement, offering up to AED 500,000 for salary transfer customers.

- Simplylife provides up to AED 500,000 for salary transfer customers, with competitive terms.

- It offers a unique emergency call-back service, prioritizing users in urgent need.

- The app does not charge extra fees for early loan settlement, adding to its customer-friendly policies.

- Simplylife is known for its straightforward and efficient service, ensuring a hassle-free loan experience.

- It’s ideal for individuals seeking flexible, significant loan amounts with consumer-oriented services.

Credy

Credy provides diverse loan services, including educational and emergency loans, with a user-friendly application process allowing up to AED 50,000 in loans within 24 hours.

- Credy offers various loan products, including educational and emergency loans.

- The app allows for quick disbursement of funds, usually within 24 hours of approval.

- Credy’s application process is simple and user-friendly, designed to take just a few minutes.

- It provides loans up to AED 50,000, catering to small and substantial financial needs.

- Credy is suitable for individuals who need versatile loan options with rapid processing times.

FinBin

FinBin offered a dependable loan service but it went offline and out of business unfortunately.

LNDDO

LNDDO was one of the first fintech startups in UAE to specialize in Lending got its License in 2021. It was known for quick loan processing within a week, aimed at individuals and small businesses needing urgent funds without collateral.

They are currently offline and out of business although they had many partnerships aimed at enabling businesses and individuals.

Benefits of Using Cash Loan Apps in UAE

- Speed and Convenience

The primary advantage of using cash loan apps in uae is their speed. Many apps promise approvals within minutes to hours, a significant reduction compared to traditional banks.

- Minimal Documentation

Another significant benefit is the reduced need for documentation. Most apps streamline the process, requiring only basic personal information and proof of income.

- Flexible Loan Amounts

Whether you need a small amount for an emergency or a larger sum for business expansion, these apps provide loans tailored to various financial needs.

Considerations Before Applying for a Cash Loan

- Understanding Interest Rates and Fees

Knowing the interest rates and any hidden fees associated with loans is crucial. Always read the fine print and understand the total cost of the loan before proceeding.

- Eligibility Requirements

Most apps have specific eligibility criteria, such as minimum salary requirements and age limits. Ensure you meet these requirements to increase your chances of approval.

- Repayment Terms

Consider your ability to repay the loan within the given timeframe. Defaulting on a loan can lead to financial penalties and affect your credit score.

FAQs

Q: How Can I Get an Instant Cash Loan in 1 Hour Without Documents in the UAE?

A: Several apps like Credy, Cash U, and FinBin offer services that require minimal documentation and provide quick disbursements.

Q: What are some other apps like Cash Now in UAE that are offering instant loans?

A: Other noteworthy apps include EZ Money, IOU Financial, and Simply Life, all known for their rapid processing and user-friendly interfaces.

Q: Is Cash Now Legal in the UAE?

A: Yes, Cash Now is legally compliant in the UAE. It uses AI technology to evaluate creditworthiness and provides one of the fastest approval times in the region.

![payment gateways uae [2024]](https://evotik.com/wp-content/uploads/2024/04/image-5-150x150.png)

![payment gateways uae [2024]](https://evotik.com/wp-content/uploads/2024/04/image-5.png)